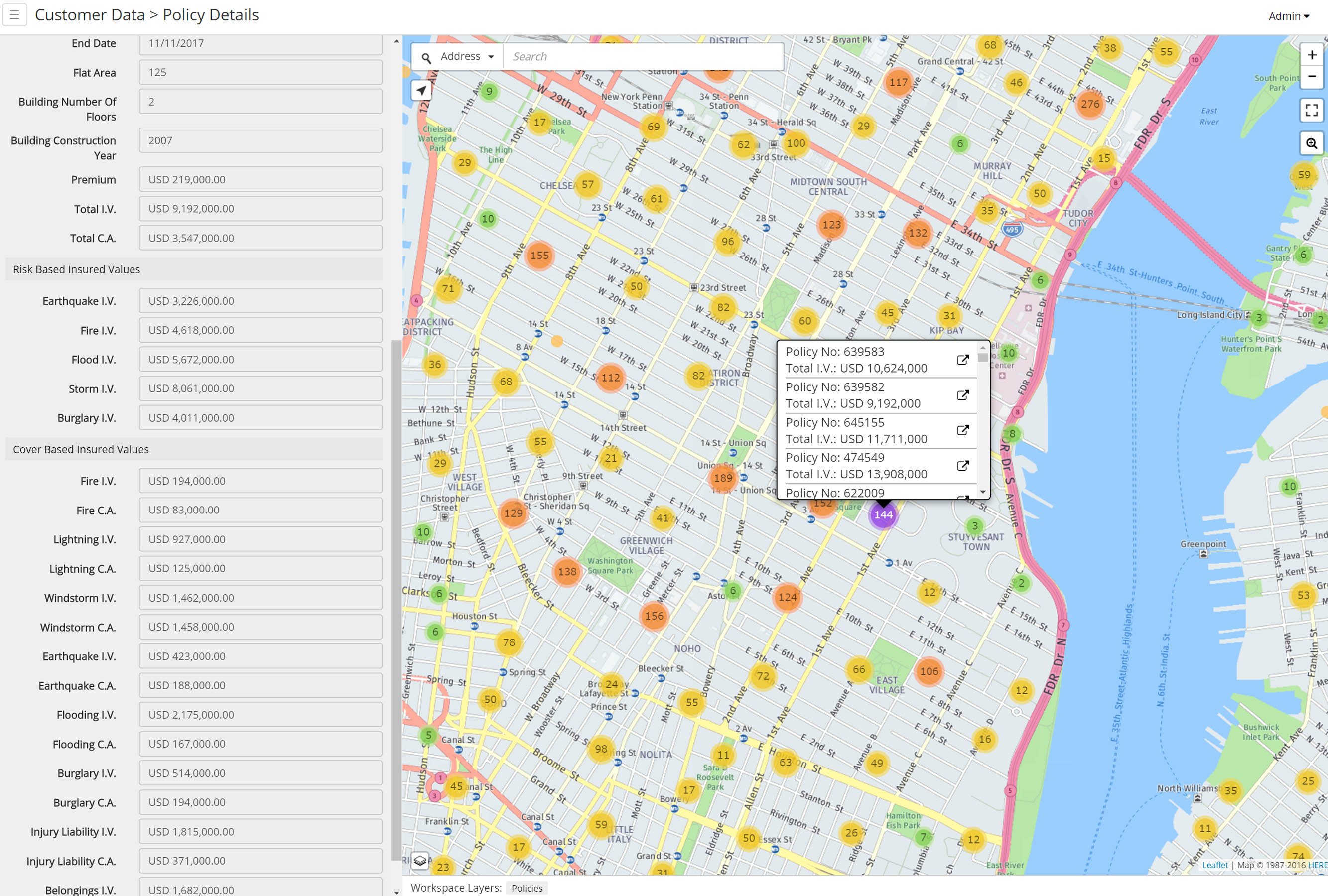

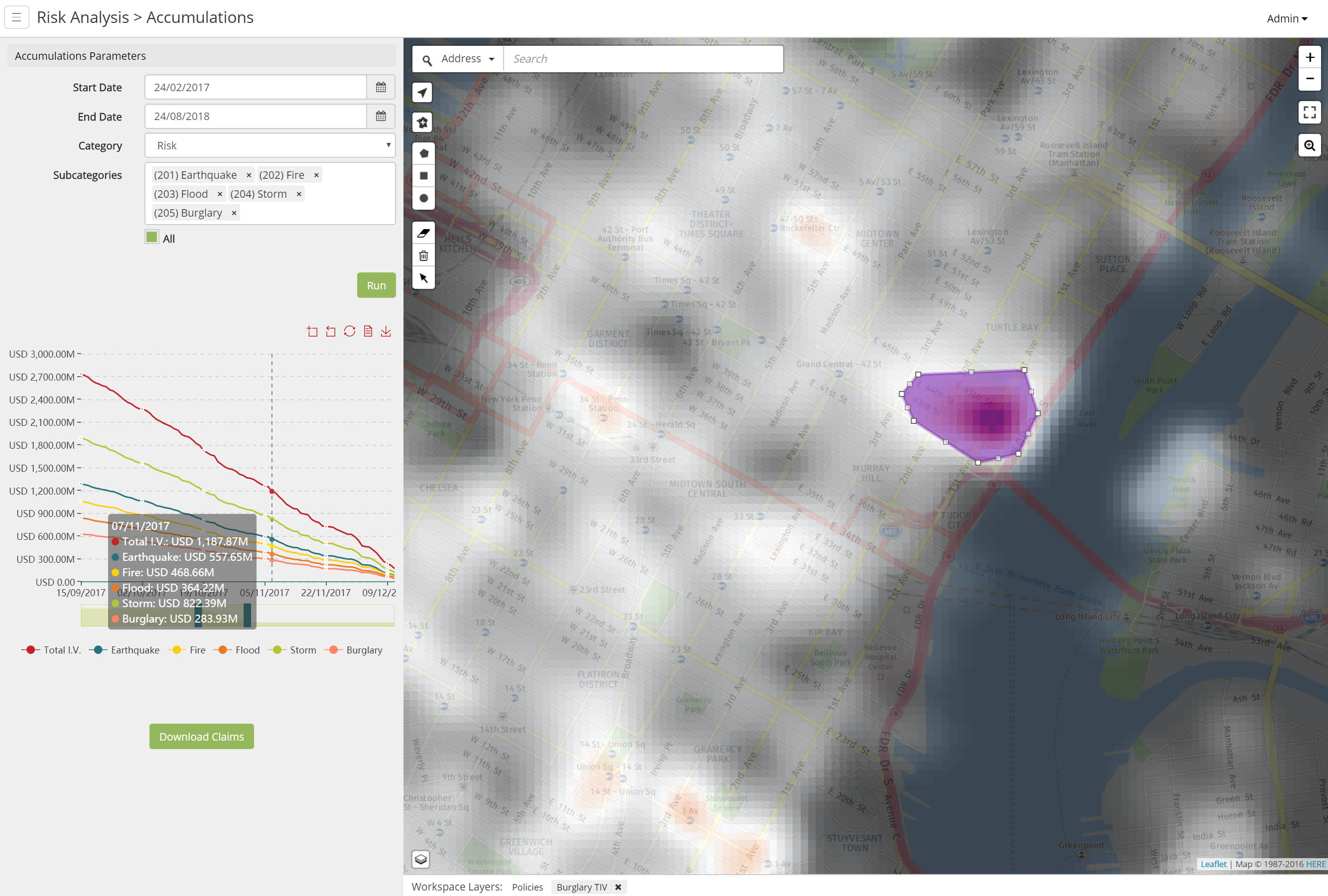

CORE

Modernize Your Underwriting

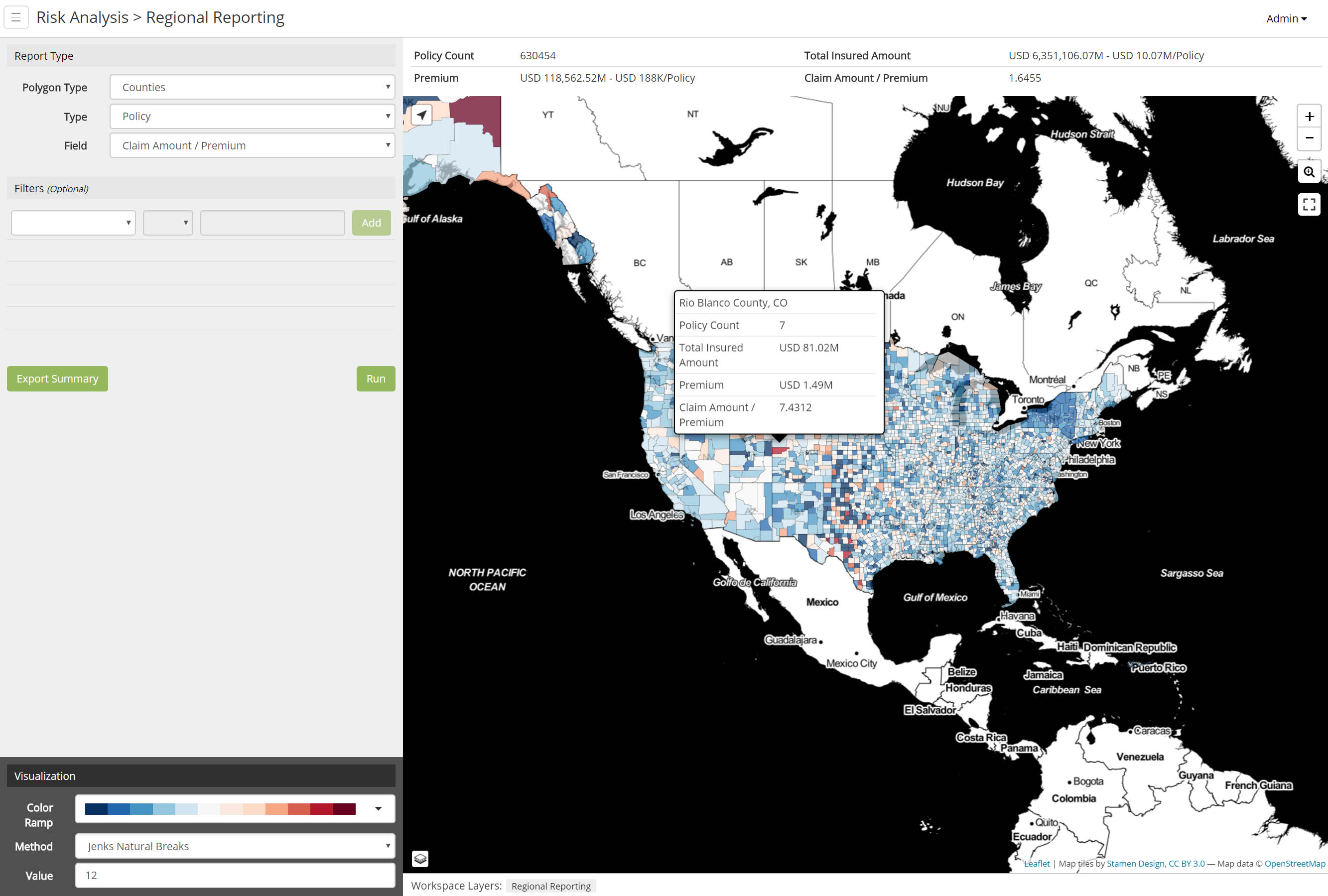

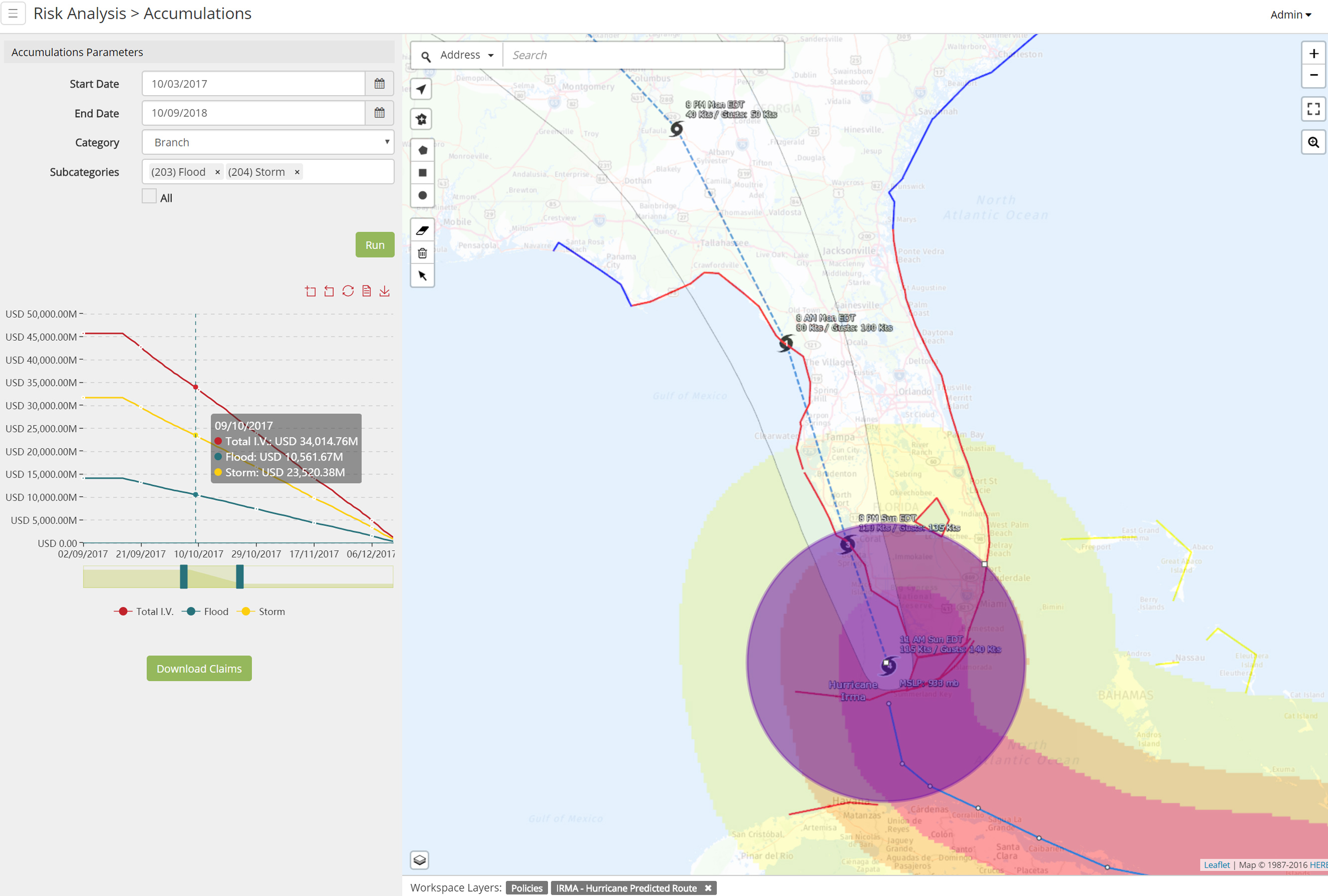

Enrich your decision making by combining geographic modeling, customer and portfolio level statistical analysis, and human intelligence while ensuring your strategic decisions are granular down to individual risks. Our dynamic Core solution works in concert with your current underwriting process in real-time and is engineered specifically for today’s complex risk requirements.